According to Steel Online's data, on October 12, many manufacturing enterprises simultaneously lowered from 610,000-970,000 VND/ton for construction steel products, to about 14.3-14.6 million VND/ton.

Domestic steel price list on October 14.

Thus, after more than a month of moving sideways, construction steel prices have continued to cool down. Notably, within just one week (from October 5 to October 12), Hoa Phat had 3 rounds of steel price reductions. The price of CB240 coils after a decrease of 720,000 VND/ton to 14.5 million VND/ton and D10 CB300 rebar decreased by 830,000 VND/ton to 14.6 million VND/ton.

From May to September, the domestic steel price has adjusted down 15-16 times, with a total decrease of about 3.7-3.9 million VND/ton depending on the brand and each product category.

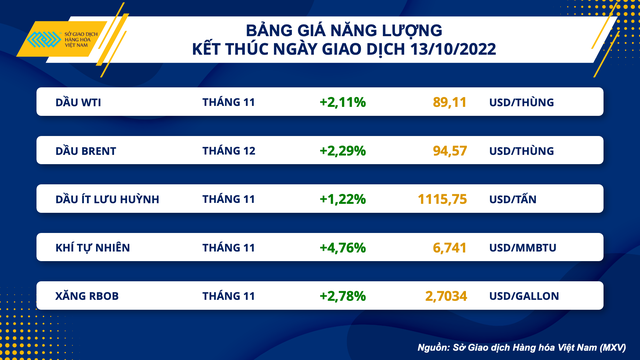

WTI oil price increased 2.11% to $89.11/barrel while Brent oil price increased 2.29% to $94.57/barrel.

Oil prices end falling streak

Oil prices rose for the first session of the week, when supply risks overwhelmed negative macro news. Specifically, at the end of the session, WTI oil price increased by 2.11% to $89.11/barrel while Brent oil price increased by 2.29% to $94.57/barrel.

During the session, there was a time when oil prices were under strong correction pressure, especially when the October oil market report of the International Energy Agency (IEA) lowered its oil demand forecast in 2022 by about 60,000 bpd, while World oil demand in 2023 is revised down by 470,000 b/d, to 101.3 million b/d. Risks to the economy, reflected in the low GDP growth rate, are the biggest factors that put pressure on oil consumption.

However, the IEA also warned there would be major uncertainty with supply, with the outcome of the OPEC meeting that could lead to a reduction in output of Middle Eastern countries by 1 million barrels per day. Russia's oil exports have fallen by 560,000 bpd since the beginning of the year, and will fall even further when the sanctions come into effect.

In addition, although the EIA report showed a sharp increase in inventories of 9.9 million barrels in the past week, production decreased, combined with exports of refined petroleum products, which increased sharply to a record 7 million barrels / year. days, and the US is about to stop opening oil reserves, the inventory data may soon reverse. In particular, the oil industry in the US seems to be having a hard time maintaining output, with maintenance sessions causing production last week to drop slightly by 100,000 bpd. Meanwhile, the number of rigs increased very slowly, and even decreased in some weeks, so it is difficult to expect any measures to add more oil to the market if the market falls into a state of shortage.

In addition, although CPI rose higher than expected, but with the Fed's interest rate hike roadmap being relatively clear, the market no longer reacted too much to inflation data. Meanwhile, besides the Fed, other central banks like the BoE are unlikely to tighten monetary policy strongly, when the risk of recession is already very high.

Vietnam Commodity Exchange (MXV)