The steel market is waiting for positive signals in the beginning of next year because normally, this will be the period when steel demand increases when construction works and a series of projects rush to accelerate.

Domestic steel prices wait for positive signals from the beginning of the year

By the beginning of December, domestic steel enterprises have moved to adjust prices, but the increases/decreases are not uniform.

With the recovery of iron and steel prices in the world in about 1 month, domestic steel prices are also recording remarkable fluctuations after nearly 2 months of moving sideways. By the beginning of December, domestic steel enterprises have moved to adjust prices, but the increases/decreases are not uniform.

Over the past few weeks, many brands have adjusted their prices several times. Notably, Hoa Phat steel has sharply increased the price of CB240 coil products to VND 14.74 million/ton and D10 CB300 rebar to VND 15.02 million/ton since the end of the week after continuously holding price. However, some other brands such as Vietnam Italy steel or Pomina steel recorded a slight decrease in prices.

According to the Vietnam Commodity Exchange (MXV), the steel market is waiting for positive signals in the beginning of next year because normally, this will be the period when steel demand increases when construction works and mass urgent projects speed up progress.

Whether steel demand in 2023 can increase strongly or not still depends on many factors, especially when steel inventories of domestic enterprises are still high. However, with the hope of China reopening, and the efforts of domestic enterprises to access new markets in the world, the steel industry will have many opportunities to recover.

Domestic steel prices wait for positive signals from the beginning of the year

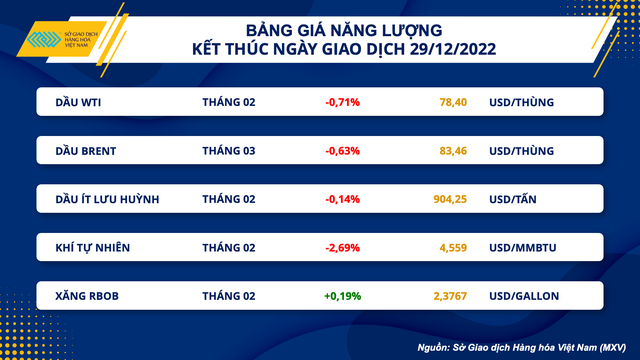

Ending session on December 29, WTI crude oil price fell 0.71% to $78.40/barrel, while Brent crude oil price dropped 0.63% to $83.46/barrel.

Pressure from both sides of supply and demand weighed on crude oil prices

Ending session on December 29, WTI crude oil price fell 0.71% to $78.40/barrel, while Brent crude oil price dropped 0.63% to $83.46/barrel.

According to MXV, the consumption outlook, which has been improving recently thanks to expectations of China's reopening, is greatly overshadowed by the risk of a large-scale outbreak. The Chinese government is lifting anti-epidemic restrictions, but the increasing number of infections here, causing many countries to apply stricter travel regulations for Chinese tourists.

Selling power dominated the oil market right from the opening, and oil prices fell even more sharply in the evening because of the weekly report of the US Energy Information Administration (EIA) showing improved supply. Specifically, US commercial crude oil inventories (excluding strategic petroleum reserves) increased by 0.7 million barrels from the previous week to 419 million barrels. While stockpiles are still 6% below the five-year average at this point, compared with a sharp 5.9 million barrel drop in the week ended December 16, the news is still weighing heavily on stocks. oil prices.

Precious metals benefit from dollar weakness

In the metal market, precious metal group simultaneously received positive buying force. Gold prices rose 0.6 percent to $1,814.89 an ounce. Silver rose 1.72% to $24.25 an ounce. Platinum closed the session with the strongest gain among metals, up 3.24% to 1049.7 USD/ounce.

For the base metals group, COMEX copper price recorded a strong volatility session when the buying force was boosted in the first half of the session, but the price quickly turned around due to the epidemic risk in China. At the end of the session, the COMEX copper price fell 0.48% to 3.82 USD/lb.

Besides, on the supply side, the disruptions surrounding the Cobre Panama copper mine between the Panamanian government and Canadian mining company First Quantum are showing more positive signs as both sides agree to negotiate, thereby contributing to pressure on copper prices. This is a copper mine that can produce up to 300,000 tons a year, or about 1.5% of worldwide copper production.

In the opposite direction, iron ore prices increased by 1.74% despite the negative epidemic situation in China. Low iron ore inventories at steel mills, while high production demand ahead of the Lunar New Year holiday supported iron ore prices during the session.