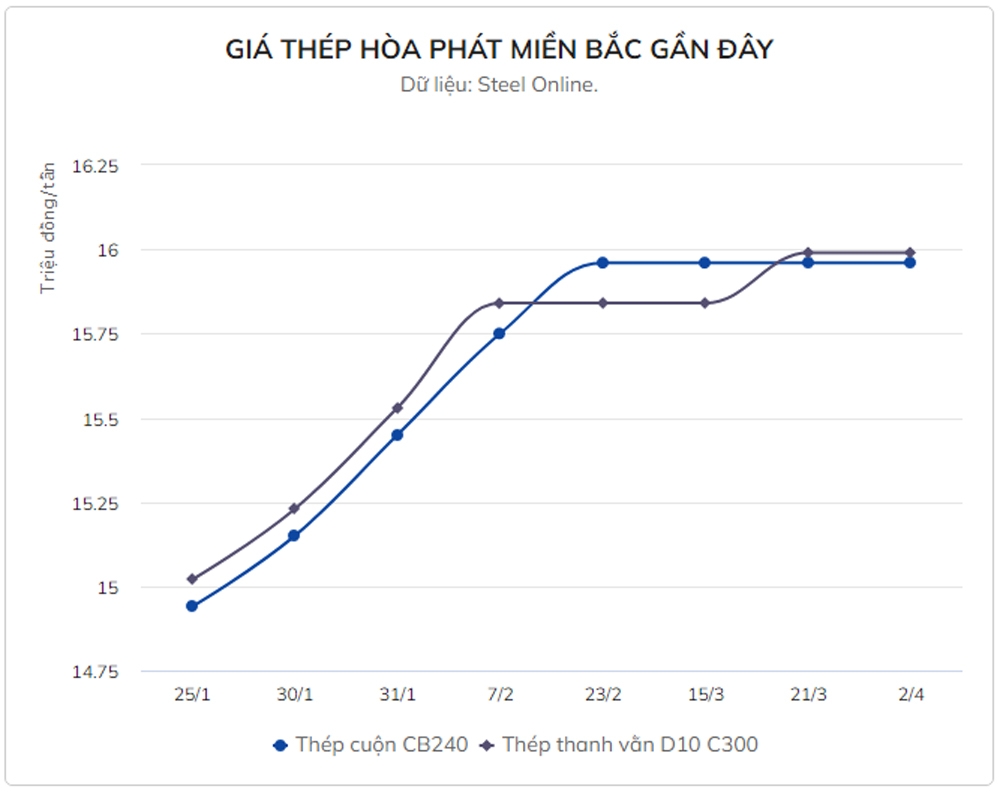

From March 21 to now, many domestic steel manufacturers have adjusted the price of rebar D10 CB300, currently priced at about 15.9-16 million VND/ton.

In a recent announcement, Hoa Phat Group Joint Stock Company has adjusted an increase of 150,000 VND / ton with the line of D10 CB300 rebar in the North and South regions. After adjustment, steel prices in the two regions are 15.99 million dong/ton and 16.03 million dong/ton, respectively.

In the Central region, Hoa Phat increased by 160,000 VND/ton with this striped steel item to 15.89 million VND/ton.

Similarly, Vietnam Italy steel brand also increased by 150,000 VND/ton with D10 CB300 rebar to 15.96 million VND/ton, while CB240 coil remained at 15.91 million/ton; Viet Duc Steel also increased by 150,000 VND/ton to 15.96 million VND/ton of rebar.

With an increase of 150,000 VND / ton, the price of D10 CB300 rebar of Kyoei brand is being sold to the market at 15.99 million VND / ton.

Particularly, Thai Nguyen Steel brand increased by 100,000 VND/ton and 150,000 VND/ton respectively for CB240 and D10 CB300 steel coils. After adjustment, these two items are currently priced at 15.86 million/ton and 15.96 million/ton, respectively.

Meanwhile, enterprises such as Southern Steel, Tqis Steel, Pomina Steel, Vina Kyoei... have not yet moved to increase prices.

Thus, from the beginning of the year until now, the price of D10 CB300 rebar has 5 times of upward adjustment, depending on the brand. Currently, the steel price level has recovered to the period of July-August last year. This price is much higher than the average of 12.5 million VND/ton before the hot surge lasting from March to early May 2022.

Businesses all believe that the increase in steel prices is mainly due to the scarcity of input materials when many factories have stopped producing ingots in some furnaces from the previous year. In addition, factories have to pay orders signed during the year, causing steel prices to increase locally due to low supply.

In the context that the market has not changed much, the prospect of the steel industry in 2023 is forecasted to continue to be difficult, especially in the first half of the year.

Experts of VNDirect Securities Company assessed that domestic steel producers are facing a series of difficulties such as falling global construction demand, rising input material prices and excess supply from the end of the year. 2022.

Besides, the outlook in 2023 of this industry is also weighed down by the gloom of the residential real estate market.

Meanwhile, at the recent 2023 Annual General Meeting of Shareholders, Mr. Tran Dinh Long, Chairman of the Board of Directors of Hoa Phat Group, affirmed that the most difficult period of the steel industry has passed, the long-term prospect of the steel industry has passed. industry is positive.

However, the steel billionaire emphasized that the industry's recovery speed will depend entirely on market demand. Currently, market demand is still too low, not only in the steel industry but also in many other industries.

According to Lien Pham/Zingnews.vn